Home loan calculator: EMI Calculator for home loan with prepayment, extra payment, taxes and insurance. This Home loan EMI calculator also calculates the interest and EMI prepayments saved by making regular extra payments on your home loan.

| Principal & Interest (EMI) | ₹1,690 |

| Monthly Extra Payment (from Oct 2013) | ₹0 |

| Property Taxes | ₹350 |

| Home Insurance | ₹66 |

| Maintenance Expenses | ₹0 |

| Total Monthly Payment | ₹2,244 |

| Down Payment, Fees & One-time Expenses | ₹35,000 |

| Principal | ₹3,15,000 |

| Prepayments | ₹0 |

| Interest | ₹2,93,755 |

| Taxes, Home Insurance & Maintenance | ₹1,60,783 |

(Oct 2013 - Sep 2043)

How to use Home Loan EMI Calculator?

Use our Home loan EMI calculator with prepayment, extra payment and taxes to calculate EMI, interest and total payment along with amortization schedule. Following are easy steps to calculate Home loan EMI, interest and total payment:

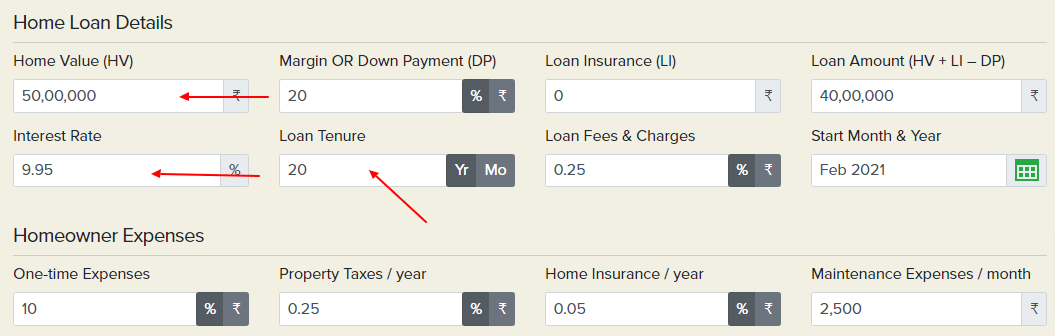

Step 1: Enter home loan values.

Enter home value, interest rate, loan tenure, down payments and loan insurance.

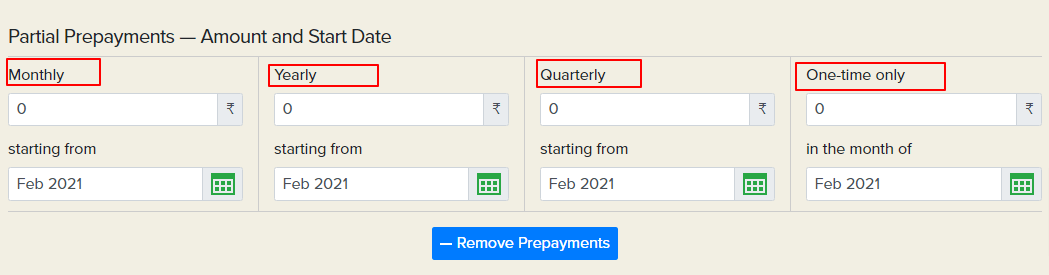

Step 2: Add Home loan prepayment amount and date.

Click on the add prepayment button, then add your prepayment amount and start date in one-time only or monthly or quarterly or yearly.

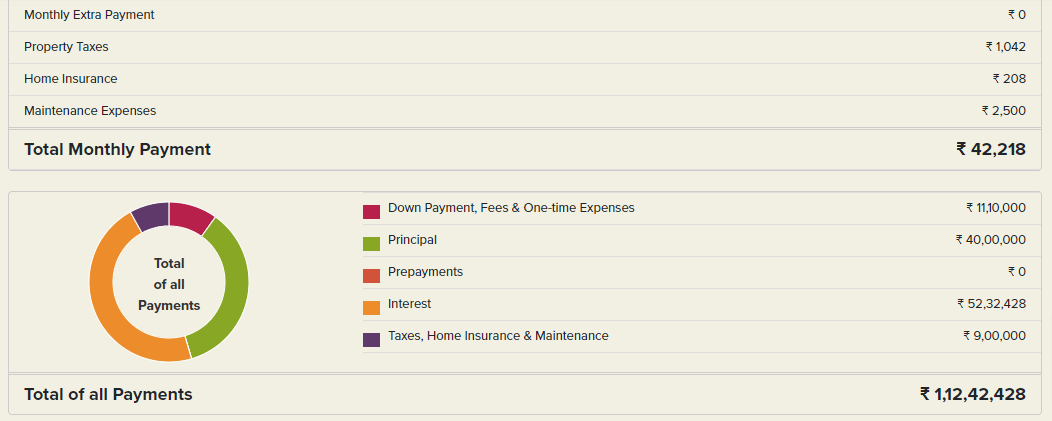

Step 3: Get Home loan EMI, total interest payable and total payment.

Now you will get Home loan EMI, total interest rate and total payment calculations based on your entered values.

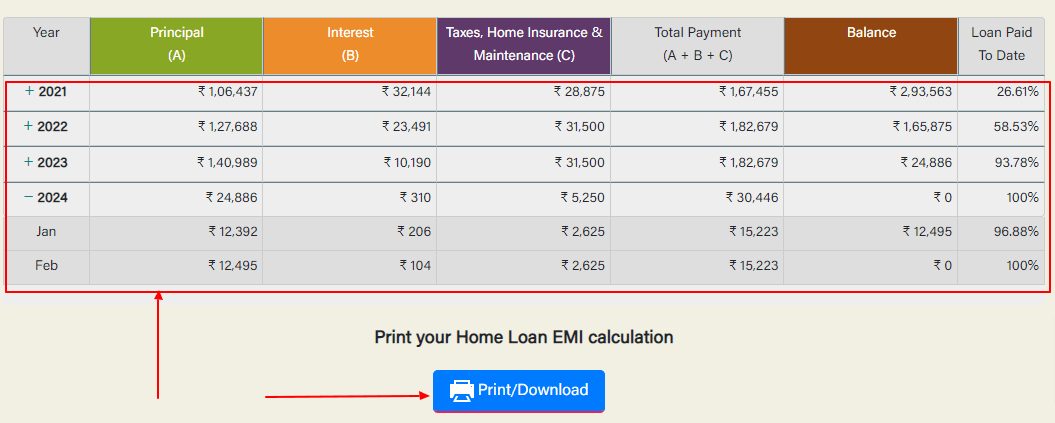

Step 4: Check and Download your home loan EMI calculation and amortization schedule.

Click on the print/download button to Download your home loan EMI calculation and home loan amortization schedule.

Financial Tools

What is Home Loan EMI?

Home Loan EMI can be defined as the monthly payment you have to make in order to repay your home loan. This repayment has a term in which you have pay back the loan and it can be calculated with the help of a Home Loan EMI Calculator, EMI is Equated Monthly Installments.

Everyone wants to own their dream home and a home loan makes your dream true. So, whether you have plans to purchase a plot for house construction, buying a resale property, or you want remodel your current home, you can go for a home loan. If you have taken a loan, it is mandatory to pay it back via paying regular EMIs.

An EMI mainly includes two factors – Principal Repayment + Interest Payment. During the initial days of the loan term, a considerable part of EMI will go towards interest payment. But as the loan advances, EMIs start to add towards the repayment of the principal amount.

Why should use Home Loan EMI calculation?

Every loan you take comes with their own eligibility factors that, as an applicant, you have to fulfill. Apart from that, you should also know the amount you can comfortably pay as EMI every month. Owing to this, a Housing Loan Calculator India can give you an idea of what will be your monthly payments, before you have actually applied for the home loan.

Loan Parameters Required to Deploy Home Loan EMI Calculator

While you are using this EMI Calculator for calculating your home loan, there are certain parameters you should be aware of. The un-fussiness of this online Home Loan EMI Calculator straightaway concerns the minimum efforts and the ability to offer tailored results.

Prepayments

Most of the subscribers favor making prepayments on their loan. This point is highly considered in the EMI Calculator for home loans as it is given here.

Loan Term

Mention the term of the loan. This can be done when you pin the term on the related slider.

Processing Fee

Once you have made your decision on a bank to apply for your home loan, the bank will verify the documents you have submitted. Generally, the documents required by the bank are – your name, complete valid address, age, income verification, and the selected property. For doing all these checks, the bank asks for a processing fee.

Rate of Interest

The amount should be entered in its designated field. Normally, the range of home loan interest rates charged by the banks is 9.50% to 12.75%. The number you have suggested gets attributed with regard to the percentage value, thus you don’t need to enter the % marker.

Features of Home Loan EMI Calculator

The obvious advantages of using this to calculate monthly home loan payments are that it helps you save your precious time, energy, and patience. In addition, there are other benefits which are as follows:

Prepayments

This EMI calculator has prepayment option and date of payment to further advanced EMI calculations.

Amortization Schedule

Our Home loan calculator generates amortization schedule for monthly and yearly EMI. You can also download it by clicking on the print/download button.

Taxes, Insurance and Down payment

You can also have taxes, insurance, maintained and down payment options in this Home loan EMI calculator.

Free of Cost

If you calculate your EMI with this Home Loan Calculator, you don’t have to pay anything.

Speed

This calculator also performs the calculations at a lightning speed, so that you have time to make other important decisions of your life.

Simple

Simplicity is the key element of this Home Loan EMI Calculator. The whole process is pretty much the same as using a standard calculator. Voila! It’s that simple.

Experiment

This calculator tests different interest rates and term combinations; this helps you to have a suitable home loan.

What are the types of Home Loan Interest Rates?

Considering the home loan, the interest rate is considered as one of the decisive factors. Let us discuss the key methods of calculating the interest rates on the principal amount.

Fixed Rate Home Loans

In this type, the interest rate stays even during the term of the loan. Since the rate stays the same, the interest rates will not undergo any change. Entirely depending on the bank offer, you may switch to the floating rate system, once you have completed a set duration into the loan term.

Pros – Since there is no change in the interest rates, you will be familiar with the interest charges you need to pay. The recurrent rate fluctuations will not influence your loan and the best part is you get to save money in the longer run even if there is an increase in the lending rates.

Cons – If the lending rates come down, you will not be benefited as the interest component stays fixed.

Floating Rate Home Loans

As it is self-explanatory by its name, the interest charges on your home loan subjected to current lending rates of the bank. The rates will entirely depend on the current rates of the bank which in turn are dependent on various elements such RBIs new insurance policy and the revision of the lending rates.

Pros – The best part of having a floating rate is that you make the most of being billed on the current rates. Just in case the rates come down, you get to make savings on interest charges.

Cons – In a rare scenario, if the standard rates surge unexpectedly, the loan has to face the consequences of being billed a much higher rate.

How to get best house loan interest rates?

In order to have the best interest rates for your house loan, there are certain things you need to know. Let us discuss them –

Your bank may not offer the cheapest loan

If you are salaried, then you must have received a pre-approved home loan by your bank. But, these may not be the lower interest rates in the market. Make sure you take some time out and compare the offers of other main banks before you apply.

Stay away from the market gimmicks

You must have come across a loan agent who will try to lure you by quoting lower interest rates. But, make sure you don’t fall for such market gimmicks. It is important to check and get the rates in writing before you give your documents for the processing.

Take a smart decision

While you decide on your loan amount, it is imperative to act smart and choose the loan amount that you are eligible for. The best way to apply for a loan amount is to either go for less than or up to that to have the best rate of interest.

Avoid applying with multiple banks

Be informed that your home loan application gets recorded in your CIBIL report. If you are applying for too many home loans simultaneously, it may affect your odds of getting a loan and in the worst cases can even surge the interest rate as well. If you are applying for multiple loans, it is a sheer signal of desperation to have a loan.

Home Loan Calculator FAQ

How to calculate Home loan EMI?

Use our Home loan EMI calculator to calculate your home loan EMI. Simply enter loan amount, interest rate and loan tenure to get all details. For advanced users, use prepayment and taxes options to simplify the complex EMI calculations on home loan.

How to download home loan EMI calculation?

Once all Home loan EMI calculations done, simply click on the print/download button to download Amortization schedule and EMI calculations on your home loan.

What should I know about Home loan prepayments?

If you are interested in making home loan prepayments during the term of your loan, then you need to click on the add prepayment button and provide the details.

What is the Formula to Calculate Housing Loan EMI?

If you are wondering about the formula for calculating your Home Loan EMI, then without wasting anytime refer to the following formula. The home loan EMI formula is E = P x r x (1+r)^n/((1+r)^n – 1).

As I am new to this EMI calculating thing, kindly give me a rundown on the details?

Using this EMI Calculator for Home Loan, you can have the information under three varied components – Amortization Tables, EMI Amount, and Breakup Charges.

Do I need to sign up or are there any set conditions required to use this Home Loan EMI Calculator?

No, for using this Home Loan EMI Calculator, you don’t have to undergo any sign-up process. And there are no qualifying conditions as well. This EMI calculator for home loan is free for ever.

Can you please provide information regarding the home loan processing fee?

If you really want to know more about the home loan processing fee, make sure you have checked the related documents provided by your bank. You can also refer the official website of the bank or you can call the bank executive to get your queries answered.